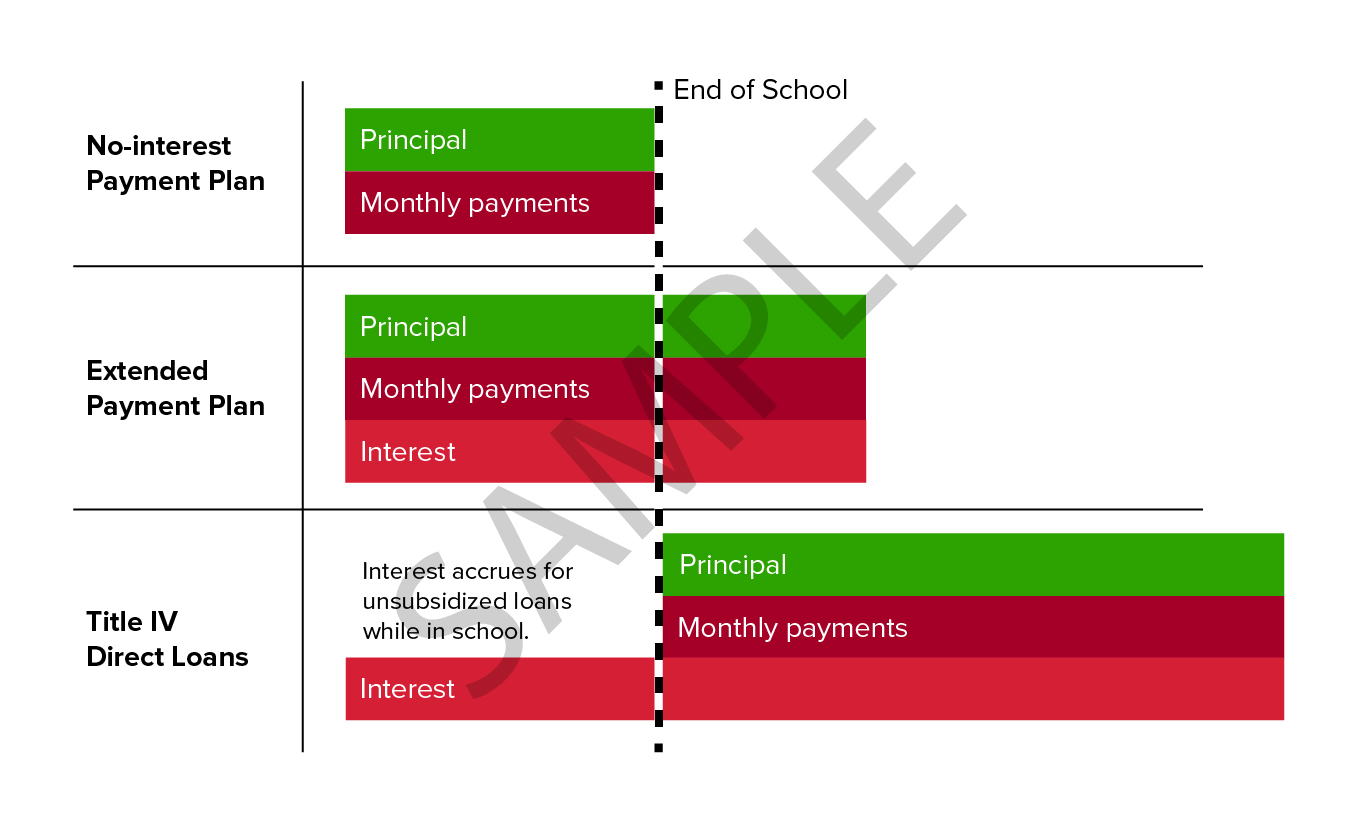

Have you considered using SDI’s no interest payment plan instead of borrowing student loans? It can help reduce your total loan debt and save you money on interest.

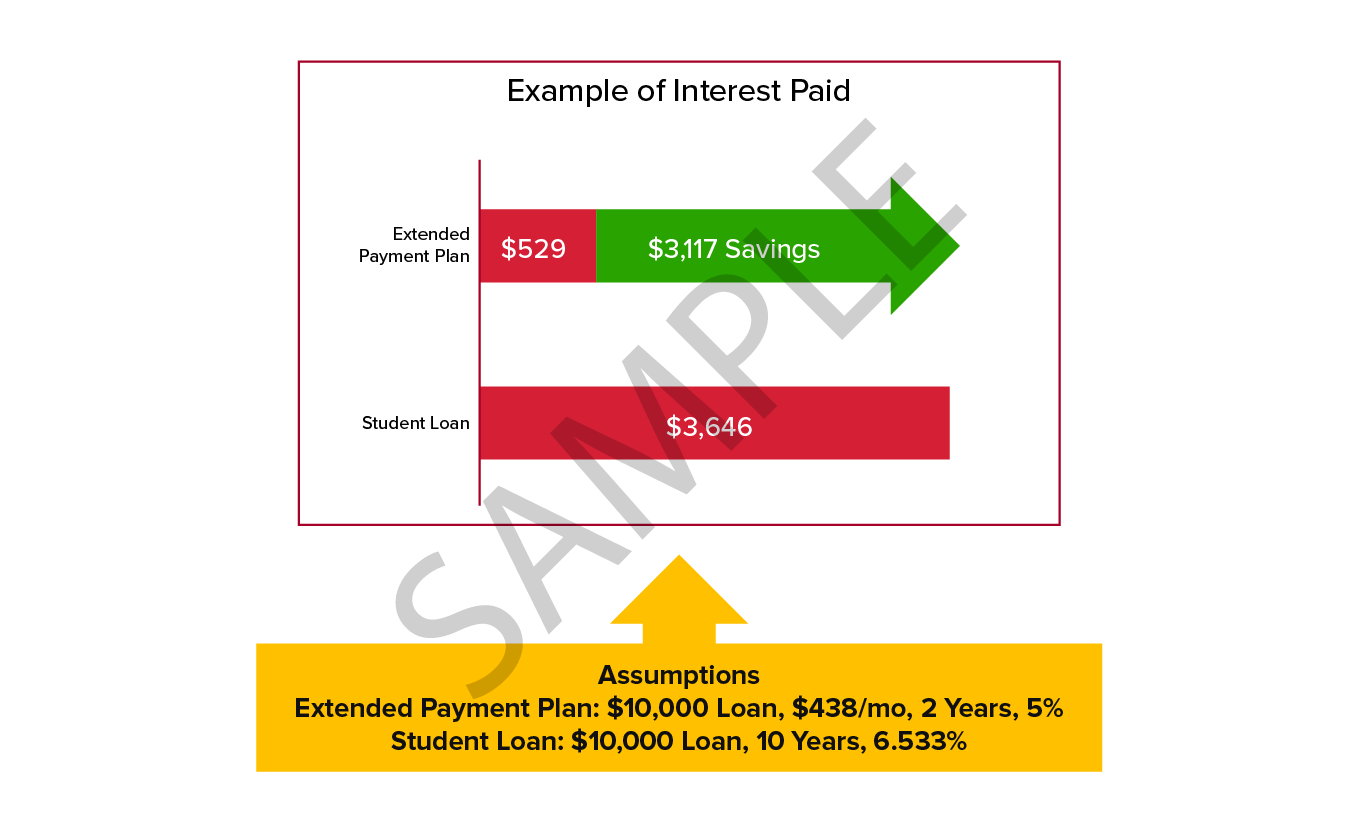

For example, if you borrow $10,000 in student loans at a 6.533% interest rate, you could pay approximately $3,646 in interest alone over a standard 10-year repayment plan.